Issue

How to create an Accumulated Depreciation Account in Class.

This is mainly for non-SMSF entities in Class.

Resolution

To resolve this issue, you will need to:

Step 1: Create a Custom holding account

Step 2: Add new Income Expense Type for depreciation expense

Step 3: Process the Depreciation Expense

Step 4: Take up amount in Accumulation Account

Step 5: Match Transaction

Create a Custom holding account

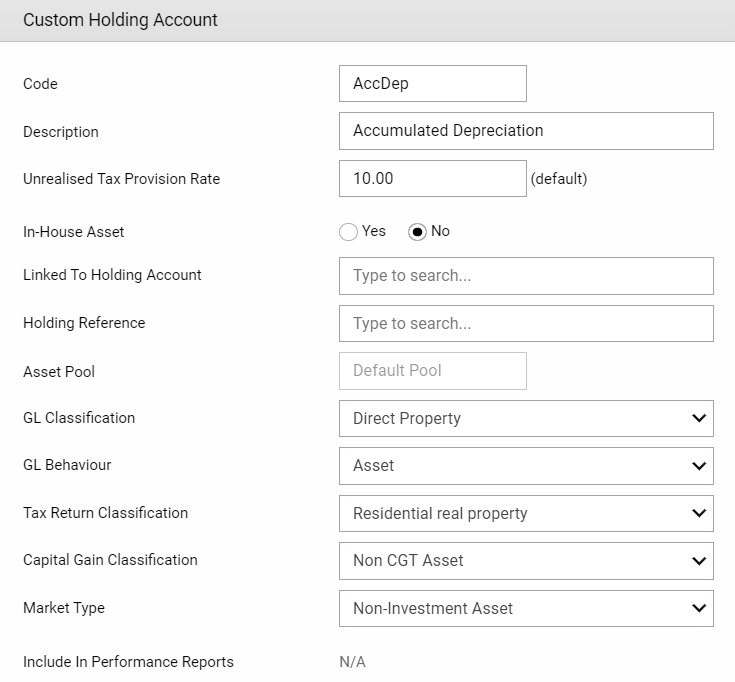

This Custom holding account will be used to carry the Accumulated Depreciation for the property.

See below screenshot as an example

Refer to the User Guide on Custom Holding Account for detailed steps.

Add a new Income Expense Type for depreciation expense

As the current expense type will reduce the book cost of the property directly, a new income expense type should be processed in order to apply against the Accumulation Depreciation.

See below screenshot as an example

Refer to the User Guide on Income and Expense Type Settings for detailed steps to set up a new Income/Expense Type.

Process the Depreciation Expense

Navigate to the Fund Level > Transactions > General Investment expense

- Select the new expense type from the drop-down list.

- Date should normally be 30 June

Take up amount in Accumulation Account

Navigate to Fund Level > Transactions > Browse Bank statement

- Select Accumulated Depreciation

- Click on Add button

- Enter a Cash Out transaction with the same amount as the depreciation expense

Match Transaction

Navigate to Fund Level > Transaction > Match Transactions

- Match off the Business event and Cash transaction

Later when selling the property

When selling the property, clear up this Accumulated Depreciation Account, by adding in a Cash Out Transaction.

To reduce the book cost of the property, process a Capital Return to the property. refer to User Guide for detailed steps on processing a Capital Return.

Do not use a Depreciation Worksheet if you are using the Accumulated Depreciation Account method.

For CWD, which is a tax only expense, refer to knowledge base article How to process a Tax Only Income or expense for further information.