Issue

When validating the Annual Return, the below error message appears:

"Total assets do not equal total liabilities"

"Limited recourse borrowing arrangements information incomplete"

How do I fix this?

Cause

The property or loan account is not set up correctly in Class for LRBA.

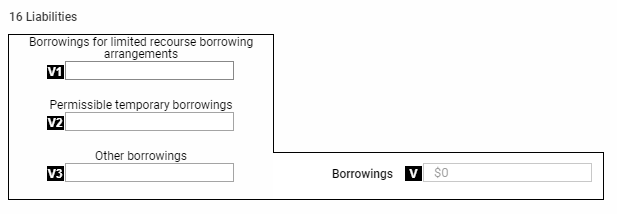

In the Annual Return, the loan amount is picked up as a negative figure in the assets part of section H, but it should be showing as a positive figure in the liabilities part.

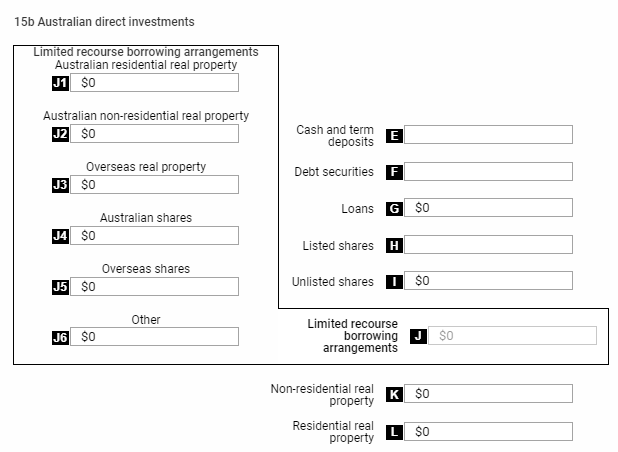

Also, the property is picked up as a non-residential/residential real property in section K or L, but it should be showing as a limited recourse borrowing arrangements (LRBA) in section J (J1, J2 or J3)

Resolution

To resolve this issue you will need:

Step 1: Change the Tax Return Classification for the loan

Step 2: Change the Tax Return Classification for the property account

Change Tax Return Classification for the loan account

Navigate to Fund Level > Investments > Browse Holding Accounts

- Click on the loan account

- Click on Asset Classification

- Change the Tax Return Classification to 'Borrowings-LRBA'

Change Tax Return Classification for the property account

Navigate to Fund Level > Investments > Browse Holding Accounts

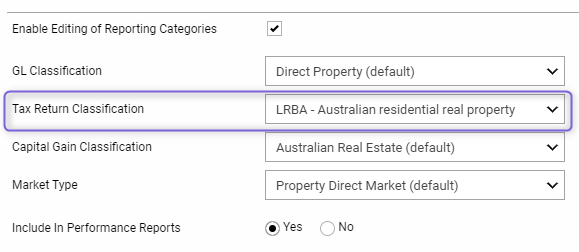

- Click on the property account

- Click on Edit

- Tick the checkbox to Enable Editing of Reporting Categories

- Change the Tax Return Classification to:

- 'LRBA - Australian residential real property' for residential properties

- 'LRBA-Australian non-residential real property' for commercial properties

What's Next?

Learn more about Limited Recourse Borrowing Arrangements (LRBA) Set-Up by selecting Limited Recourse Borrowing Arrangements (LRBA) Set-Up